Global Insurtech Market 2025 | Share, Demand & Forecast Till 2033

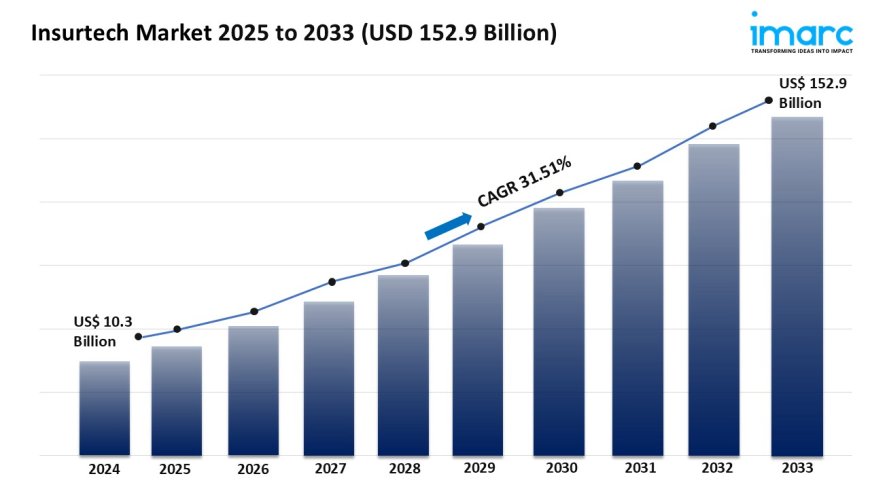

the global insurtech market size was valued at USD 10.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 152.9 Billion by 2033, exhibiting a CAGR of 31.51% from 2025-2033.

Market Overview:

The insurtech market is experiencing rapid growth, driven by adoption of artificial intelligence and machine learning, rise of digital distribution channels, and increased focus on customer-centric models. According to IMARC Group's latest research publication, "Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033, the global insurtech market size was valued at USD 10.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 152.9 Billion by 2033, exhibiting a CAGR of 31.51% from 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report:https://www.imarcgroup.com/insurtech-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Growth Factors in the Insurtech Market

- Adoption of Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are shaking up the insurtech market by making things faster and more personalized. These tools help insurers crunch huge amounts of data to better assess risks and set prices that make sense. For example, Lemonade uses AI-powered chatbots to handle claims in just minutes, creating a smooth experience for customers. ML also spots fraudulent claims by picking up on unusual patterns, saving insurers money. As AI keeps getting smarter, its helping companies predict what customers need and fine-tune their offerings, fueling growth in the insurtech market size in 2024 and beyond. This tech-driven approach is drawing in tech-savvy customers and streamlining operations, pushing insurtech firms to innovate and meet the demand for tailored insurance solutions.

- Rise of Digital Distribution Channels

Digital platforms are a big driver of insurtech growth, making insurance easier to access and manage. Online portals and mobile apps let customers compare policies, buy coverage, and file claims without breaking a sweat. Take Policybazaar in Indiaits a one-stop shop for browsing insurance options, helping people make quick, informed choices. These digital channels cut out the middleman, lowering costs and reaching more customers, including underserved groups like millennials or small businesses. By offering customized products through user-friendly platforms, insurers are boosting engagement and expanding the insurtech market size in 2024. This digital-first trend aligns with how people prefer to shop for services today, driving growth across the industry.

- Increased Focus on Customer-Centric Models

Insurtech companies are putting customers first, and its paying off by fueling growth. Unlike old-school insurers, these firms use technology to create flexible, transparent, and easy-to-use products that solve real customer problems. For instance, Oscar Health offers health insurance plans with apps that make booking doctor visits or handling claims a breeze. By focusing on user experience, theyre building trust and loyalty. Companies like Metromile, with pay-per-mile car insurance, cater to modern needs with flexible options. This customer-focused approach is reshaping the industry and boosting the insurtech market size in 2024, as more people seek personalized, hassle-free insurance solutions that fit their lifestyles.

Key Trends in the Insurtech Market

- Growth of Usage-Based Insurance

Usage-based insurance (UBI) is a prominent trend in the insurtech market, offering policies tailored to individual behaviors. By leveraging telematics and IoT devices, insurers track real-time data, such as driving habits for auto insurance or health metrics for life insurance. For instance, Progressives Snapshot program monitors driving patterns to offer discounts to safe drivers. UBI appeals to consumers seeking fair pricing and encourages safer behaviors, reducing claims costs. This trend enhances customer engagement by aligning premiums with actual usage, fostering transparency. As IoT technology advances, UBI is expected to expand across various insurance types, redefining pricing models.

- Emergence of Embedded Insurance

Embedded insurance, where coverage is seamlessly integrated into other products or services, is gaining traction in the insurtech market. This trend allows consumers to purchase insurance at the point of sale, enhancing convenience. For example, Amazon offers device protection plans during checkout, embedding insurance into the purchase process. Similarly, ride-sharing platforms like Uber provide driver insurance as part of their service. This approach expands market reach by tapping into existing customer journeys, particularly in e-commerce and mobility sectors. As businesses seek to enhance customer experiences, embedded insurance is becoming a key strategy, driving innovation and accessibility in the insurtech space.

- Collaboration Between Insurtechs and Traditional Insurers

Collaboration between insurtech startups and traditional insurers is a growing trend, blending innovation with established expertise. Insurtechs bring agility and technology, while legacy insurers offer scale and regulatory knowledge. For example, Allianz partnered with insurtech firm Zego to provide flexible insurance for gig economy workers. Such partnerships enable traditional insurers to modernize operations and offer digital-first products without overhauling their systems. Meanwhile, insurtechs gain access to larger customer bases and resources. This trend fosters a symbiotic ecosystem, accelerating the adoption of innovative solutions and enhancing the industrys ability to meet evolving consumer demands in a competitive market.

Leading Companies Operating in the Global Insurtech Industry:

- Clover Health LLC

- Damco Group

- DXC Technology Company

- Insurance Technology Services

- Majesco (Aurum PropTech Limited)

- Oscar Insurance Corporation

- Quantemplate

- Shift Technology

- Travelers Companies, Inc.

- Wipro

- ZhongAn Online P&C Insurance Co. Ltd.

Insurtech Market Report Segmentation:

By Type:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

Based on the type, the market has been classified into auto, business, health, home, specialty, travel, and others.

By Service:

- Consulting

- Support and Maintenance

- Managed Services

On the basis of the service, the market has been divided into consulting, support and maintenance, and managed services.

By Technology:

- Blockchain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

Cloud computing accounts for the largest market share due to its scalability, cost-efficiency, and ability to provide insurers with seamless access to data and applications, enabling streamlined operations and enhanced customer experiences.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America's dominance in the insurtech market is attributed to its robust technological infrastructure, high adoption rates of digital solutions, and well-established insurance industry, making it a fertile ground for the growth of insurtech companies.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the worlds most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145